Developed countries should hike taxes on oil products in a bid to accelerate moves to a low-carbon future.

By -Paul Stevens, Chatham House.

This week in Shima, Japan, the G7 is attempting to address the major challenges of growing uncertainty in the global economy, including the sharp drop in oil prices. Last month I had the opportunity to brief Shinzo Abe, Japan’s Prime Minister on oil markets.

Out of my presentation came the idea that in what is now a competitive oil market, there exists a floor and a ceiling price for oil. The floor price is set by the variable costs of US tight oil and the ceiling in the near term by what would quickly bring on extra supply to choke off further price rises. Prime Minster Abe then asked me what the optimal price within that range might be? I suggested there was a conventional answer: high enough to ensure future supplies but not so high to inhibit global growth. However, I also pointed out a new issue that cannot be ignored: namely the threat of climate change.

To address this requires reducing greenhouse gas emissions which requires moving away from hydrocarbon energy. An obvious way to help to achieve this is to increase the price of hydrocarbon energy and let markets do the rest. However, there are problems with this solution. In particular, in an increasingly globalized world, there is growing concern about national export competitiveness. If a government acts unilaterally to increase energy prices, there is a real danger this will damage the ability to export and will certainly generate significant political pressure to reverse such increases. The only way to avoid this is if all the major players agree to act in the same way at the same time. The question is can this realistically be achieved? The answer is yes, because the G7 has done it before.

In the immediate aftermath of the first oil shock of 1973-74, OECD governments were reluctant to pass on the higher price to consumers for several reasons. Above all, Keynesian thinking drove macroeconomic policy. Thus the post-shock economic recession required a counter cyclical increase in aggregate demand not a decrease created by increasing energy prices. Also raising oil prices would create cost-push inflation. Finally, there were serious concerns by countries facing growing balance of payments problems over export competitiveness if their energy prices rose relative to others.

By the time of the second oil price shock of 1979-81, the world had changed. Keynesian economics had been supplanted by Monetarism. Thus recession was not driven by inadequate aggregate demand and no countercyclical manipulation was required. Also inflation was purely a monetary phenomenon. Cost-push inflation did not exist. However, the oil shocks of the 1970s and their threat to energy security had created a serious imperative to reduce oil import dependence. The obvious way to achieve this was to increase energy prices. This was especially true in a Monetarist world where markets rule but countries were still concerned about export competitiveness and governments were reluctant to increase energy prices.

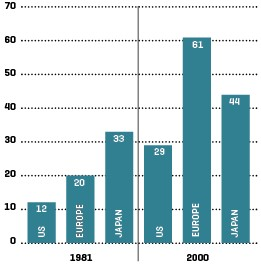

This problem was solved in two G7 Summits held in Tokyo (June 1979) and Venice (June 1980). Agreement was reached to more than pass on the increase in crude prices to domestic consumers to reduce oil import dependence. Effectively, if everyone did the same thing at the same time then export competiveness would not be affected. The result was a significant increase in sales taxes on oil products. Thus between 1981 and 2000, the share of sales taxes in the final price of oil products increased from 20 to 61% in Europe, 12 to 29% in the USA and 33 to 44% in Japan.

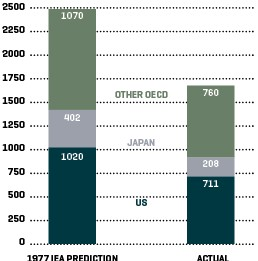

The strategy worked extremely well. In 1977, the International Energy Agency’s World Energy Outlook projected that oil consumption in 1985 would be 1,020mn tons in the USA, 402mn tons in Japan and 1,070mn tons in the rest of the OECD. By 1985, actual oil consumption was 711mn tons in the USA, 208mn tons in Japan and 760mn tons in the rest of the OECD. Overall this represented a reduction of 60% on the original forecast.

Quite clearly, a similar decision to increase hydrocarbon prices to the final consumer at the current G7 summit could calm individual fears over export competitiveness and help move to a lower carbon economy.

Last year under the G7 Presidency of Germany the Carbon Market Platform agreed to create a strategic dialogue to introduce effective measures for the transition to a low-carbon economy. While this was a laudable initiative, given the history of climate change negotiations, it will probably take years to produce an effective price for carbon. Using sales taxes to increase hydrocarbon energy prices could be a quick and expedient means for the G7 to advance the move to a lower carbon economy. This might be better done with a larger group of countries such as the G20. But someone somewhere has to start and Prime Minister Abe could be that someone. Given the G7 became rich by burning fossil fuels arguably they should make the first move.

G7: 1980S HIKE TO OIL PRODUCTS TAXES...

% TAX IN FINAL PRICE

... LED DEMAND TO FALL. CAN THIS BE REPEATED?

1985 OIL DEMAND (MN TONS)

Paul Stevens is a Distinguished Fellow in the Energy, Environment & Resources Department at Chatham House