By - John Gault*

“It is important that we look to provide rational and impartial supply and demand forecasts. We need to continually strive for more reliable and transparent data, to help alleviate uncertainty and volatility.”

- Opec Secretary General ‘Abd Allah al-Badri, Chatham House, London, 27 January 2014

The words of former Opec chief Mr Badri echo similar sentiments expressed in June 1991 by a previous Opec Secretary General, Dr Subroto. At the time, Dr Subroto’s words inspired me and my late colleague Jack Hartshorn to examine the state of oil market information. We concluded, looking back over the 1970s and 1980s, that “we have seen no net improvement in the transparency of oil industry information over the whole period from governments on either side of oil” (MEES, 17 August 1992).

Since then, governments from oil exporting and importing countries have made significant efforts to improve data timeliness, completeness and reliability. The Producer-Consumer Dialogue, initiated in the early 1990s, led to the founding of the International Energy Forum and to the creation of Jodi – the Joint Organizations Data Initiative. Jodi today collects and makes public oil and gas data from about 80 countries, including the largest exporters and importers (MEES, 23 September for analysis of the latest Saudi data).

In addition, experts from Opec and the IEA have collaborated to render their monthly oil market reports more compatible in terms of categories and definitions, and hence more directly comparable by users (see MEES, 16 September for analysis of the latest monthly supply and demand data).

Other developments since the early 1990s also would lead one to expect to find today improvements in data comprehensiveness and reliability:

• Following the dissolution of the Soviet Union in 1991, data from the FSU and other centrally planned economies (CPEs) became increasingly available. Previously, nearly all “global” data was only comprehensive for non-communist countries, supplemented by CPE net exports.

• Over the past quarter century, advances in computing systems and communications networks have vastly expanded our ability to record, assemble, process, store, analyze and transmit data.+

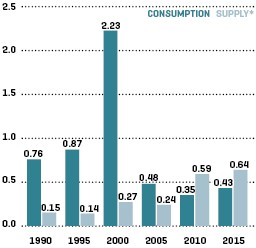

1. IEA OIL MARKET REPORTS: RANGE OF REVISIONS TO PREVIOUS YEAR’S GLOBAL OIL DATA (%)

*INCLUDES CRUDE, NGLS, PROCESSING GAINS & BIOFUELS.

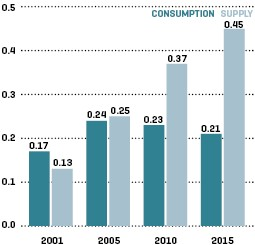

2. OPEC MONTHLY OIL MARKET REPORTS: RANGE OF REVISIONS TO PREVIOUS YEAR (%)

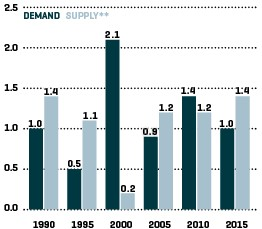

3. IEA OMRs: AVERAGE ABSOLUTE REVISION OF QUARTERLY PROJECTIONS (%)*

*THREE MONTHS AFTER CLOSE OF QUARTER, COMPARED WITH FIRST MONTH OF QUARTER. **NON-OPEC SUPPLY.

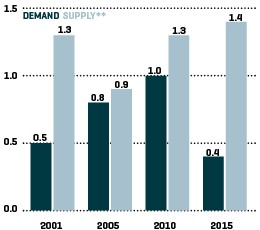

4. OPEC MOMRs: AVERAGE ABSOLUTE REVISION OF QUARTERLY PROJECTIONS (%)*

*THREE MONTHS AFTER CLOSE OF QUARTER, COMPARED WITH FIRST MONTH OF QUARTER. **NON-OPEC SUPPLY

• Cargo inspection, verification and certification professionals have developed new tools and techniques; environmental regulations now require additional cargo measurements; and tanker trackers now benefit from real-time position monitoring options.

Despite these positive developments, overall improvements in oil industry data quality are difficult to identify, and areas of extreme opacity persist.

One test of data reliability is the extent to which historical data is revised following first publication. Successively smaller revisions would suggest that originally published data is gradually becoming more reliable.

An examination of the twelve monthly Oil Market Reports published by the IEA during each of the years 1990, 1995, 2000, 2005, 2010 and 2015 reveals an overall improvement in reported global consumption data since 2000, but no long-term trend toward ever-smaller revisions to the previous year’s reported global oil supply (see chart 1).

Some observers may note that the range of the revisions – in most years, less than 1% – appears narrow, and conclude that, while the track record may not show consistent improvement over time, the level of reliability is nevertheless acceptable. Yet even errors in initially-published data of this seemingly minor magnitude can have serious impacts on investment decisions and price expectations.

For example, errors in consumption and supply data do not necessarily offset each other. Together, they can yield excessive preliminary estimates of counter-seasonal stock builds or stock draws, in some cases leading to speculation about “missing barrels” (see for example, MEES, 30 July 2012). Perceptions based on exaggerated inventory drawdowns or stock overhangs influence investors on oil futures markets, and can add to price volatility.

Small errors in base-year data used for long-term forecasting can seriously distort projections of oil demand or supply. Even a minor initial error can compound into a significantly misleading market outlook 10 or 20 years hence. Minimizing such forecasting uncertainties is essential, given all the other risks that must be considered when making a major investment decision.

Applying the same test of data reliability to Opec’s Monthly Oil Market Report reveals no clear trend toward improvement in data reliability (see chart 2). Since 2001, on average, the Opec OMR has made smaller revisions to year-earlier data than has the IEA OMR. No trend can be observed in revisions to global oil consumption data, but revisions to global supply data have become gradually larger.

Both the IEA and Opec continue to revise demand and supply data in their monthly reports as late as the third succeeding year. The most recent IEA OMR Statistical Supplement (August 2016) revises global oil consumption data as far as 14 years in arrears, and global oil supply data four years into the past. The BP Statistical Review of World Energy likewise revises historical annual demand and supply data stretching many years into the past. Neither the IEA nor BP offer explanations for their revisions.

Persistent gaps in data reporting are highlighted by Opec’s practice of publishing, in each monthly OMR, two separate tables for OPEC member’s oil production: one based on direct reporting, the other drawn from secondary sources.

THE RELIABILITY OF FORECASTS HAS NOT IMPROVED

Mr Badri’s concern, stated at the outset of this article, is that unreliable supply and demand forecasts contribute to oil price volatility. Alas, it is difficult to find signs that the quality of short-term oil projections has improved in recent years.

The test applied here compares projections made at the beginning of a calendar quarter with the consumption and supply data reported three months after the close of the quarter. If forecasting had improved, one would expect to find that the absolute magnitude of revisions has diminished over time.

Unfortunately, little if any improvement can be identified. The test applied to the IEA OMRs is illustrated in chart 3, while that for the Opec OMRs is shown in chart 4. Apart from the observation that Opec forecasters did remarkably well in projecting global oil consumption in 2015, no general trend is apparent from either publication.

RESERVES DATA INCOMPLETE

In our 1992 article, Jack Hartshorn and I noted the difficulty of estimating the cost of net additions to oil production capacity in the Middle East, particularly because reservoir decline rates of existing fields were then (and remain today) generally unavailable. While new investments were occasionally announced publicly, observers could not determine the extent to which these investments added net capacity rather than merely offsetting normal production decline.

Estimating the cost of incremental production capacity in the Middle East was an important issue in the early 1990s. Global demand, which had declined in the early 1980s, was again growing, but Opec capacity was not keeping pace, and Kuwait’s fields had been damaged in the 1990-91 conflict. While average costs of production in the Gulf undoubtedly remained the lowest in the world, concern was rising that incremental costs of new capacity were increasing sharply. Independent analysts like ourselves found it difficult to measure the extent of this increase.

Concern continues about the rising cost of incremental production capacity in the Middle East, spurred by individual examples such as the reported $18,000 per barrel/day of capacity invested in Saudi Arabia’s offshore Manifa field that came onstream in 2014. This per-daily-barrel investment exceeds by several multiples the highest costs contemplated in the early 1990s, yet Manifa did not expand Saudi Arabia’s official overall production capacity at all.

Today, the question of rising cost of incremental capacity in the Middle East receives less attention than it did 25 years ago, possibly for several reasons:

• Attention is focused instead on the cost of unconventional oil, particularly ultra-deep offshore discoveries, synthetic crude from bituminous deposits, and oil released from tight formations by fracking. Incremental oil from these mainly non-Opec sources, undisputedly more expensive than Middle Eastern conventional crude oil, constitutes global marginal supply.

• Costs themselves have proven to be elastic. The two greatest oil price collapses – in 1986 and in 2014 – induced dramatic contractions in global oil industry investment and in the prices of upstream services. Under such circumstances, the “cost” of incremental capacity becomes a fuzzy concept.

• It is clear that the incremental cost of production capacity does not dictate the oil price level at which Opec members feel sufficient financial hardship that they institute a collective price stabilization effort. This price level is determined more by individual domestic budget requirements. In the case of Saudi Arabia, the anticipated cost of achieving its ambitious Vision 2030 economic diversification away from oil dependence undoubtedly will enter into the calculation.

Despite this change in focus, access to reliable and complete information about oil reserves, both at the national and individual reservoir levels, remains important. Some non-Opec countries publish detailed information. Norway sets the highest public standard by publishing annual reservoir-by-reservoir data, but this is not new: they began doing so as early as the mid-1980s. No Opec member country regularly publishes comparable, comprehensive data.

The opacity of Opec oil reserves information persists despite:

• Efforts by both advocates and adversaries of “Peak Oil” theories to penetrate the murkiness;

• The tightening of US SEC reserve reporting rules for publicly traded companies that came into effect in 2010;

• The suspiciously unchanging official reserves figures of Opec member countries, apparently unaffected by either investments or reservoir depletion;

• Sharply differing estimates of OPEC members’ reserves announced by independent analysts.

It is possible that greater transparency in reserves reporting will be forthcoming if Saudi Arabia carries out its plan to privatize part of Saudi Aramco. The Deputy Crown Prince emphasized, in an interview with Al-Arabiya Television, that privatization should enhance transparency:

“Offering Aramco has several benefits; most importantly transparency. People in the past were displeased with the fact that Aramco’s numbers are undeclared, unclear, and non-transparent. Today, it will become transparent. If Aramco were to be listed on the market, its figures must be announced as well, and it will be under the supervision of all the Saudi banks, analysts, and thinkers. All the international banks and the studying and planning centers in the world will scrutinize Aramco intensively.”

If Saudi Aramco is privatized, even partially, expectations will grow for other Opec governments to offer shares in their wholly state-owned national oil companies. The companies must then submit to reporting rules of securities regulators and to questioning by shareholders. Greater transparency, not only of financial performance but also of oil reserves, should emerge.

Today, however, one must conclude that only limited improvements in oil industry data reliability and transparency have occurred over the past 25 years. Secretary General Badri’s plea, cited at the outset of this article, remains urgent.

*The author is an independent energy consultant based in Geneva.